UBO extract

What is the UBO extract in Germany?

Germany maintains a register called Transparenzregister to record the Ultimate Beneficial Owners (UBOs) of legal entities. This register was created as part of the country’s compliance with the EU Anti-Money Laundering Directive (AMLD) and is governed under the GwG (Geldwäschegesetz), Germany’s Anti-Money Laundering Act.

Any person who directly or indirectly holds more than 25% of the shares or voting rights, or otherwise exercises control over a legal entity, must be disclosed as a UBO. UBO registration is mandatory for most corporations and associations, and the data must be submitted or confirmed by the reporting entity. Since 2022, the German register has been publicly accessible in accordance with EU law although access is subject to legitimate interest criteria.

What does it look like?

Key Elements

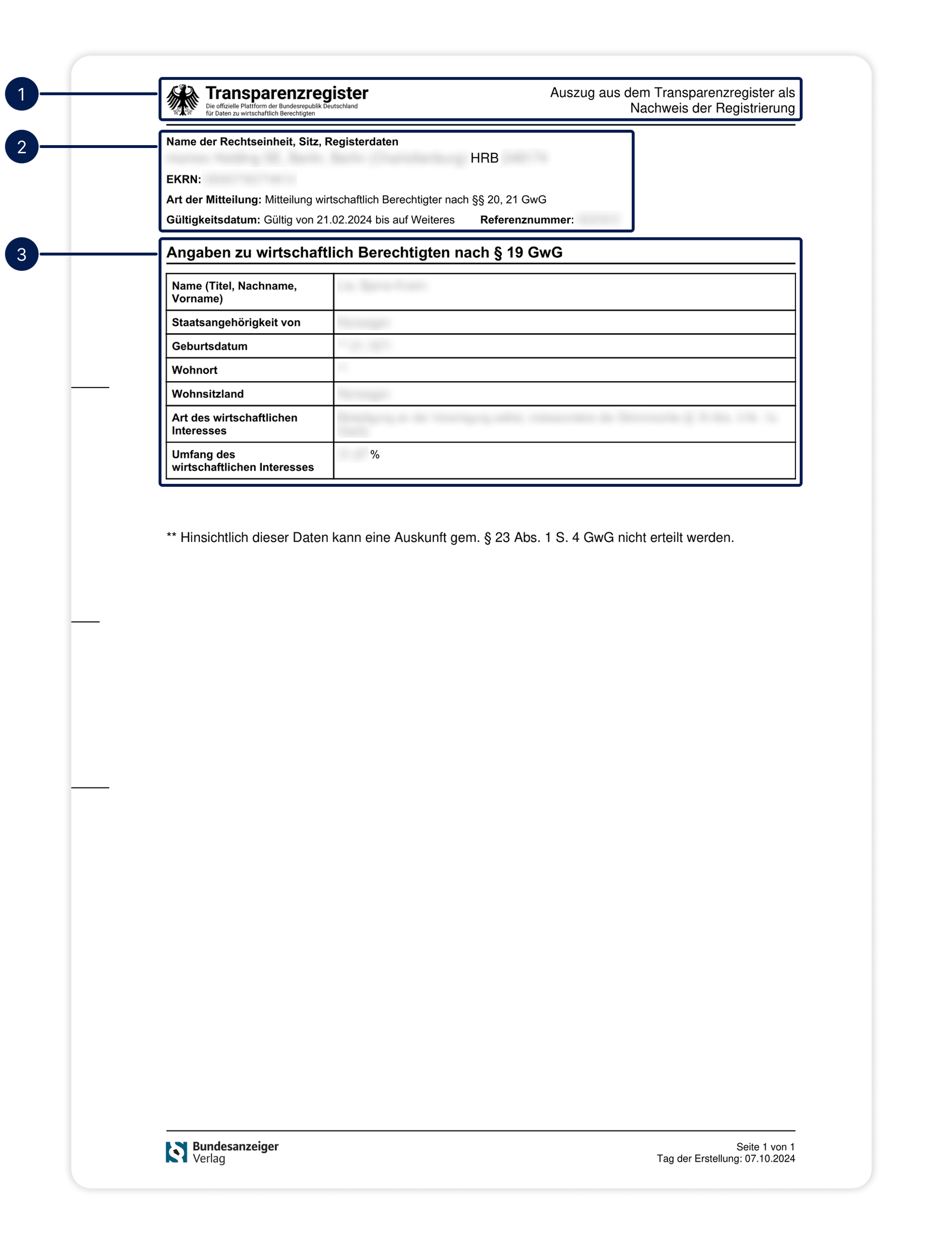

1. Register logo and header which proves the document is coming from the Transparenzregister

2. Legal entity information

- Company’s legal name, id and city of registration

- EKRN id (Einheitliche und kontinuierliche Rechtseinheitsnummer): this is an 11-digit number specific to the Transparenzregister to identify legal entities

- Type of filing (Art der Mitteilung): reference to the legal obligation type

3. UBO Details

- Full name and title

- Nationality

- Birthdate

- Living address (not always displayed

- Type and structure of ownership

- Percentage of capital ownership and/or control held

With Semaphore

Semaphore provides direct access to the UBO extract from the Transparenzregister through a dedicated partnership with the German authority. In addition to retrieving the official document, we also deliver the UBO data in a structured JSON format for seamless integration.

For enhanced analysis, Semaphore can also extract shareholder information to build a capital ownership tree. This allows you to cross-check the data declared in the Transparenzregister with the underlying shareholder structure, offering deeper insights and improved validation capabilities, aside all others company data and documents.