Financial Statements

Financial Statements (jahresabschlussunterlagen) in Germany

In Germany, companies are required by law to submit their annual financial statements (Jahresabschluss) to the Unternehmensregister, the official company register. This obligation applies to all corporations (Kapitalgesellschaften), including GmbH, AG, UG, and cooperatives, as mandated by the EHUG law (Gesetz über elektronische Handelsregister und Genossenschaftsregister sowie das Unternehmensregister).

The Jahresabschluss provides a comprehensive view of a company’s financial position and performance. It typically includes a balance sheet (Bilanz) and an income statement (Gewinn- und Verlustrechnung), and may be accompanied by notes or appendices depending on the size and legal structure of the company.

Germany applies differentiated requirements based on company size. While large firms must disclose extensive financial details, micro-entities can submit simplified balance sheets only. The legal deadline for submission is 12 months after the end of the fiscal year, reduced to 4 months for companies listed on capital.

What does it look like?

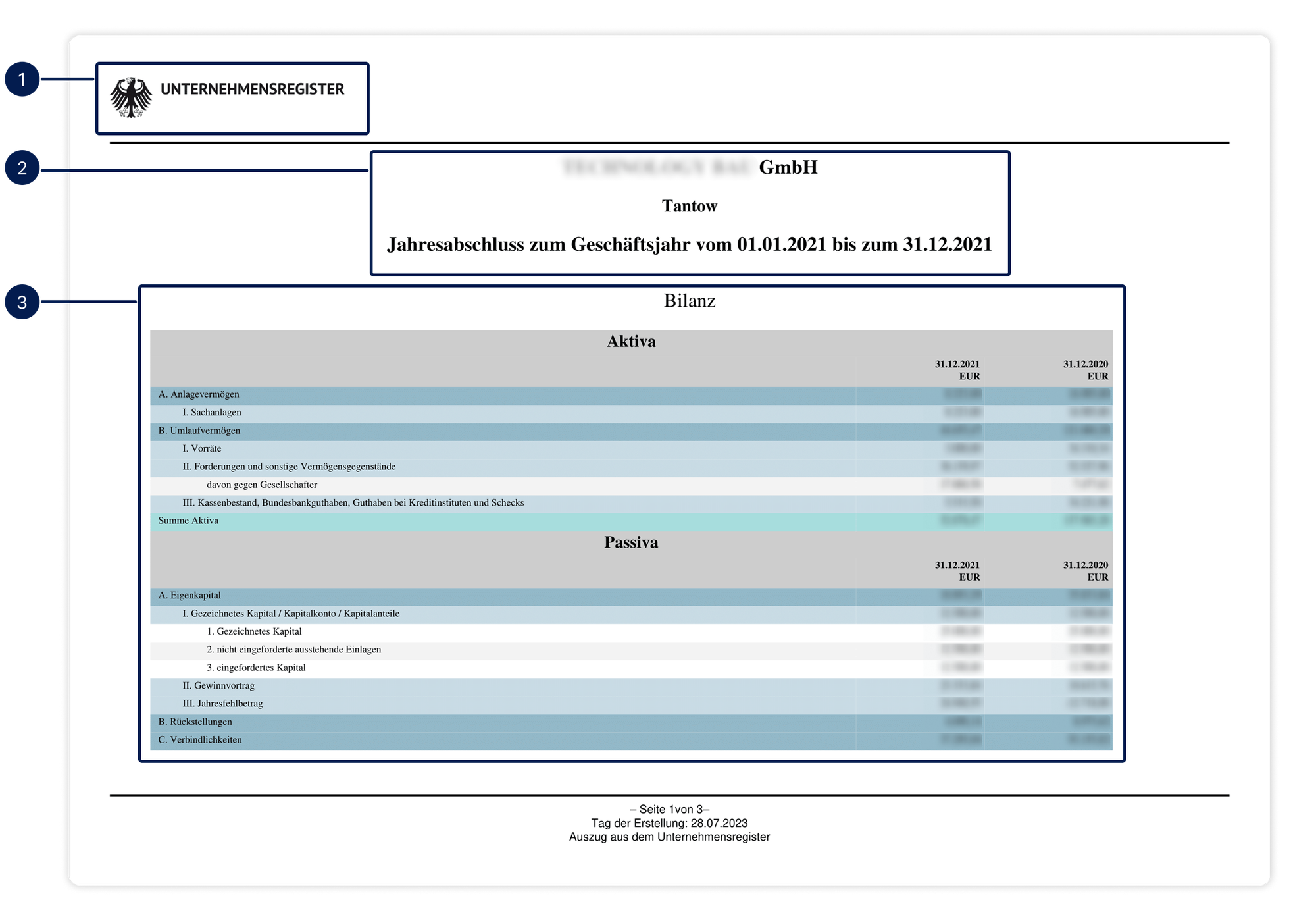

Below is an excerpt from an actual Jahresabschluss downloaded from the Unternehmensregister:

The document always includes the reporting year, company name, and registration details. The core financial data is split into two sections:

- Aktiva (Assets): fixed assets, current assets, receivables, cash, etc.

- Passiva (Liabilities & Equity): capital structure, earnings, liabilities.

Each item is reported for two fiscal years, enabling year-on-year comparison. This layout is standardized, ensuring consistency across companies and legal forms.

Key Elements

1. Official logo: it proves the document is coming from the Unternehmensregister.

2. Header Information

At the top of the document, you’ll find:

- The official logo of the Unternehmensregister.

- The company’s legal name, registration location, and the fiscal year covered.

- The creation date of the extract, which certifies the document’s validity.

3. Balance Sheet

The balance sheet is structured in two symmetrical parts:

- Assets (Aktiva): categorized into fixed assets (Anlagevermögen) and current assets (Umlaufvermögen), including inventory, receivables, and cash balances.

- Liabilities and Equity (Passiva): includes equity capital, earnings carried forward, and short/long-term liabilities.

The financial data is typically presented in euros and includes side-by-side comparison with the previous financial year, although smaller entities may omit prior-year data.

With Semaphore

Semaphore enables automated access to German financial statements via its API. Through direct integration with the Unternehmensregister, you can retrieve certified documents and extract structured financial data in seconds.

Key extracted data points include:

- Company name and registration number

- Reporting year

- Total assets and liabilities

- Share capital and retained earnings

- Net income / annual loss (Jahresfehlbetrag)

This structured access ensures full auditability and compliance with AML/CTF obligations, while dramatically accelerating onboarding and periodic review workflows.