Depósito de Cuentas (Financial Statements)

What is the Depósito de Cuentas Anuales?

In Spain, the Depósito de Cuentas Anuales is the official filing of a company’s annual financial statements with the Registro Mercantil. This filing is mandatory for all capital companies (S.A., S.L., S.L.U., etc.) and includes key financial disclosures for a given fiscal year, such as the balance sheet, income statement, cash flow, and — if required — auditor reports and complementary data.

These statements must be submitted within one month of their approval by the shareholders' meeting and no later than seven months after the fiscal year ends. The Registro Mercantil validates and archives these documents, which are then made available for third-party consultation.

What does it look like?

Here is an extract from a real Spanish financial filing report (the real document is 20 pages long with many financials annexes). All documents begins with a first page of company details. Then the real financial statements follow.

Key Elements

Description

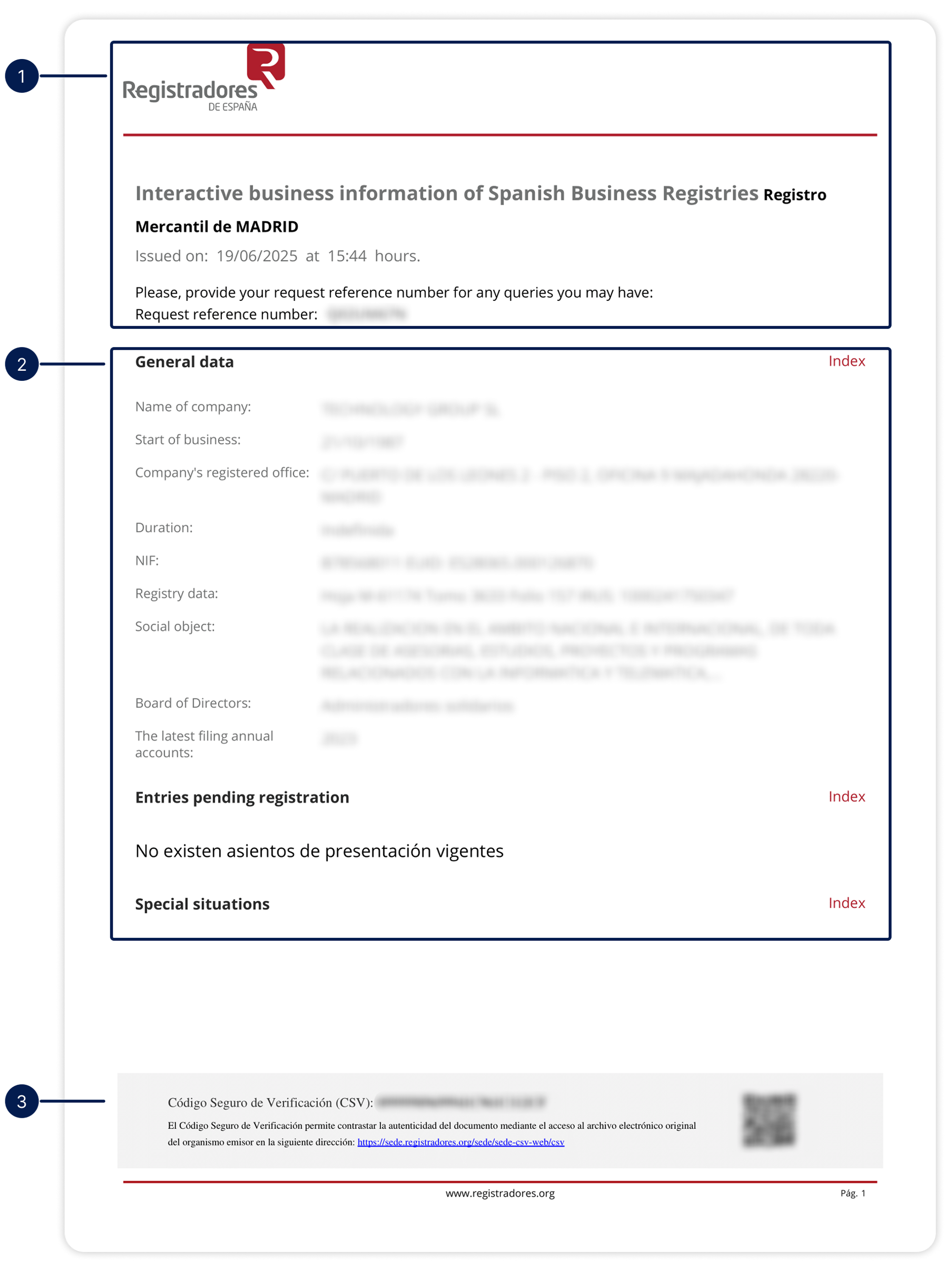

1. Filing Metadata & Authentication

Each financial statement includes:

- Date and time of issue

- Secure code (CSV) with QR

- Hyperlink to verify its authenticity on the Registradores website

This metadata guarantees the document’s traceability and legal admissibility.

2. General Company Information

Provides context on the entity:

- Legal name and tax ID (NIF)

- Registered address

- Company duration

- Registry sheet and book number

- Social object (corporate purpose)

- Current board structure

- Date of latest deposit on record (e.g., 2023 for the 2022 fiscal year)

3. QR Code to check authenticity

In addition to the timestamp, a QR code and a secure verification code (CSV) are displayed at the bottom of every page of the document.

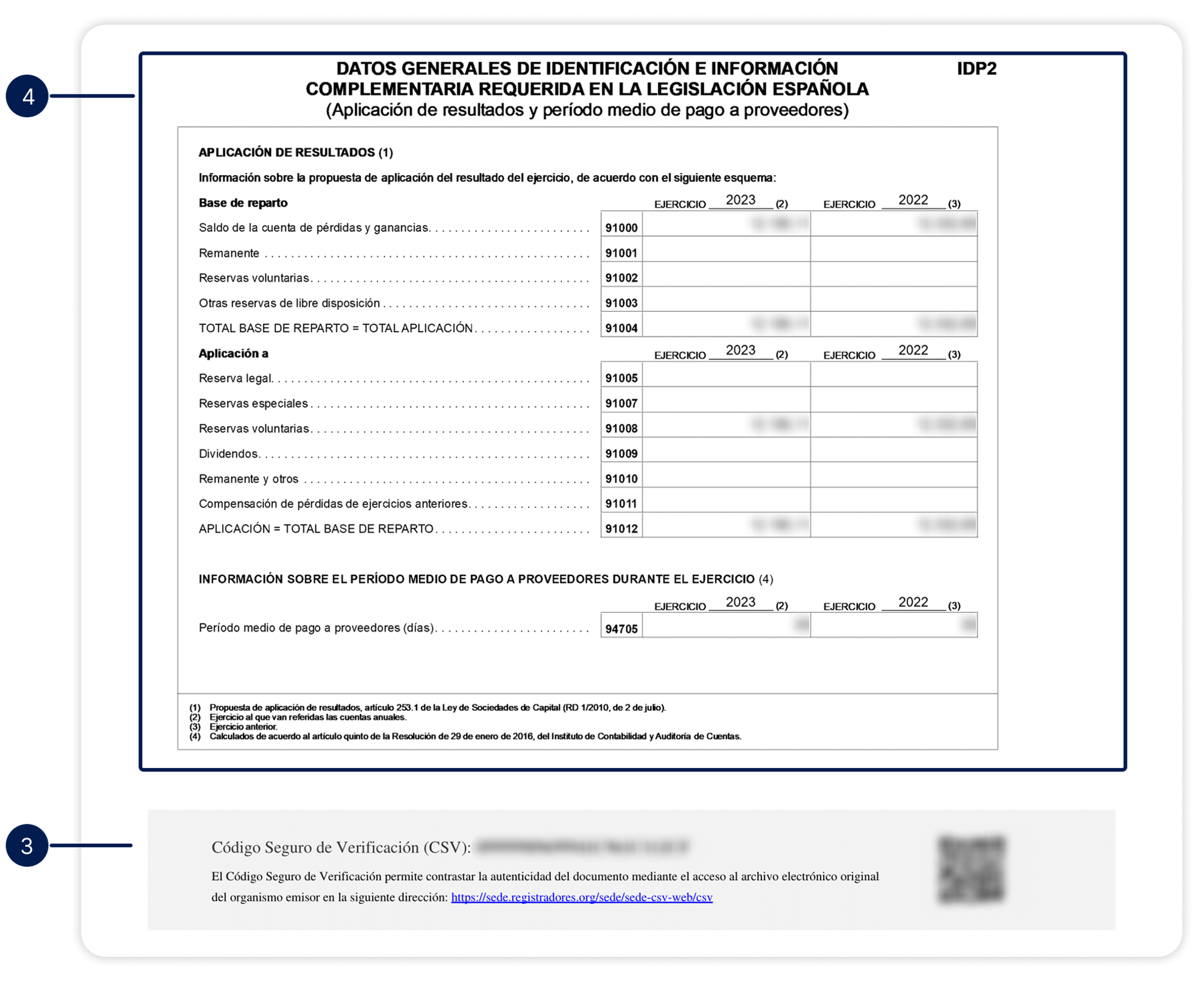

4. Sample - Aplicación de Resultados (Profit & Loss allocation)

This is only a one page extract of a 20-pages document. Many more information are available.

Cost and availability

The price of this document is relatively high, typically around ten euros. It can vary depending on the legal form — being slightly cheaper for a sole proprietor and more expensive for a company with a longer history. It is available within a few minutes from the register.

Lastly, even though registered associations are required to file their financial statements, these documents are not accessible to the public. (We refer you to our article on the Spanish commercial register for more information.)

With Semaphore

Semaphore enables automatic retrieval and structured parsing of Spanish financial statements filed with the Registro Mercantil.

With Semaphore’s API, you can:

- Access company financials in real time

- Extract key indicators: revenue, EBITDA, profit, reserves, dividends

Semaphore handles PDF parsing, document metadata verification (CSV/QR), and formatting normalization — streamlining due diligence and AML workflows across your Spanish counterparties.