Bilancio (financial statements)

What is the Bilancio d’esercizio?

The Bilancio d’esercizio is the official annual financial statement that Italian companies are legally required to submit to the Registro delle Imprese, managed by the local Camere di Commercio. It provides a comprehensive picture of a company’s financial health, performance, and balance sheet structure as of December 31 of each year.

Required under Italian corporate law, the Bilancio must be filed within 120 days following the close of the fiscal year (or within 180 days for specific legal cases). It is a vital document for anyone performing due diligence, credit risk assessment, AML/KYC reviews, or regulatory compliance on Italian entities.

There are multiple formats of Bilancio depending on company size and obligations:

- Bilancio ordinario (standard format)

- Bilancio abbreviato (simplified)

- Bilancio micro-imprese (micro-enterprises)

- Bilancio finale di liquidazione (for companies in dissolution)

What does it look like?

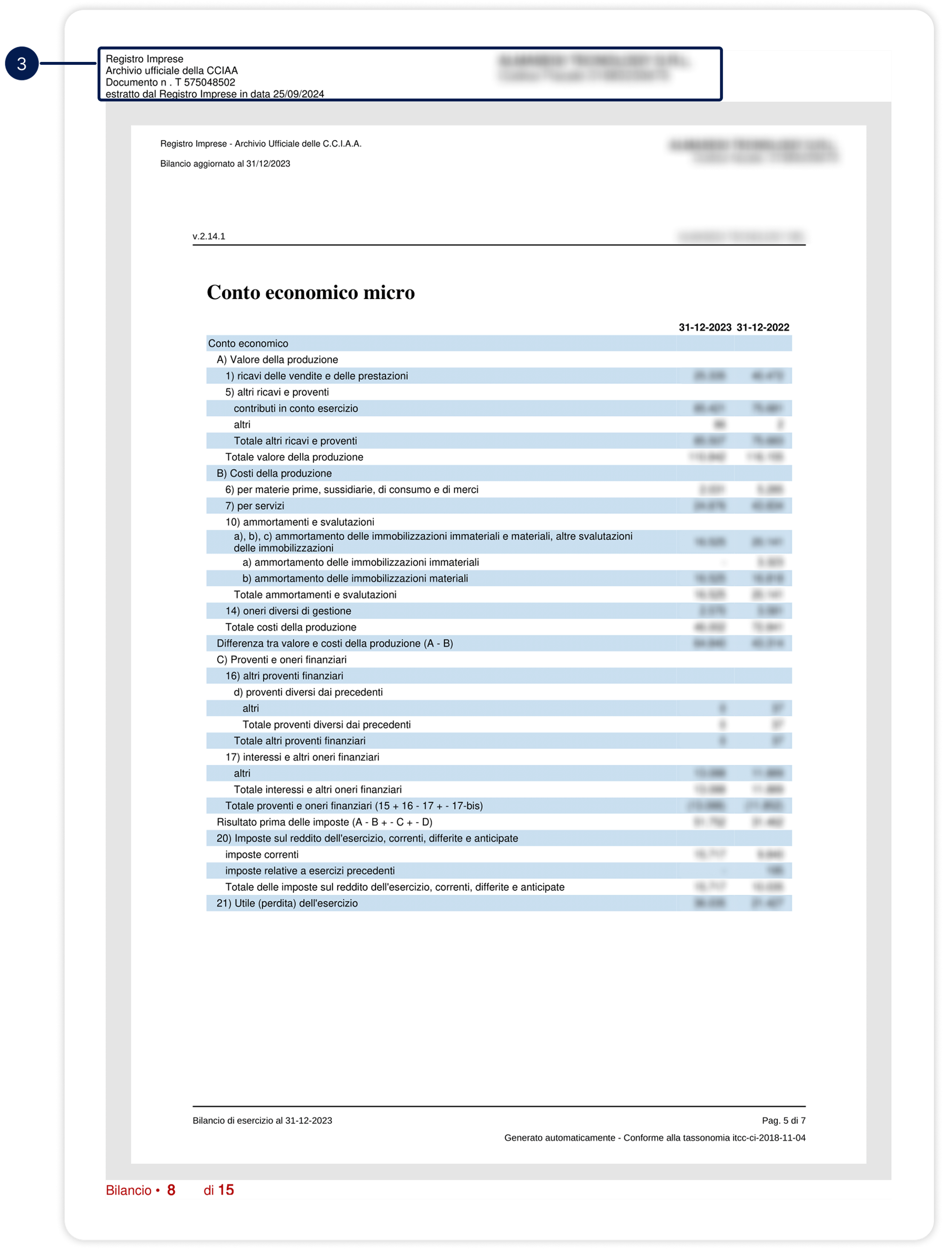

Here’s a real example of a Bilancio for an Italian S.r.l. (this is just an extract, as the original document is 13 pages long). This official document contains:

- General data (company name, address, REA number, VAT code, legal form)

- A verification QR code

- The company’s Conto Economico Micro (simplified income statement)

showing annual revenues, costs, amortizations, and net income

The Bilancio typically includes the following parts:

- Conto economico: Revenue, production costs, depreciation, financial income/expenses, and net income.

- Stato patrimoniale: A complete balance sheet (in the full or abbreviated version).

- Nota integrativa (if required): Additional explanations of figures, accounting criteria, and disclosures.

Key Elements

1. Document Header which shows it's coming from an Italian Business register

2. Document Header and Identification

The Bilancio is always issued under the authority of a specific Camera di Commercio, with full metadata:

- Company identity, REA and fiscal codes (codice fiscale)

- Pour identifier une société dans le registre, il est important d'utiliser avant tout le code fiscal. Le code REA, bien qu'unique, est surtout utilisé en Italie à des fins statistiques

- Legal seat, digital PEC address (Posta Elettronica Certificata)

- Date of incorporation and last protocol

- Signatory administrator (e.g., Amministratore Unico)

Each document includes a QR code that allows instant validation on the Registro Imprese platform.

3. Filing Timeline and Formats

The statement is auto-generated and certified by the Registro delle Imprese. The document ID and the date it was collected are also visible.

Relevant extract - Conto economico micro

Micro-enterprises like the one in this example only file the Conto Economico and are exempt from submitting a full explanatory note even if the original document is 13 pages long).

With Semaphore

Semaphore provides automated access to Bilancio d’esercizio documents directly from the Registro Imprese. This includes:

- Retrieval of official and timestamped financial statements

- Parsing and structuring of financial data (revenue, EBITDA, net result etc.) in a JSON format

- Identification of filing formats (micro, abbreviato, ordinario)

Thanks to Semaphore’s API and parsing layer, you can easily integrate verified Italian financials into your onboarding, KYB, and risk workflows.