Annual return in Ireland (form B1C)

What is the Annual return?

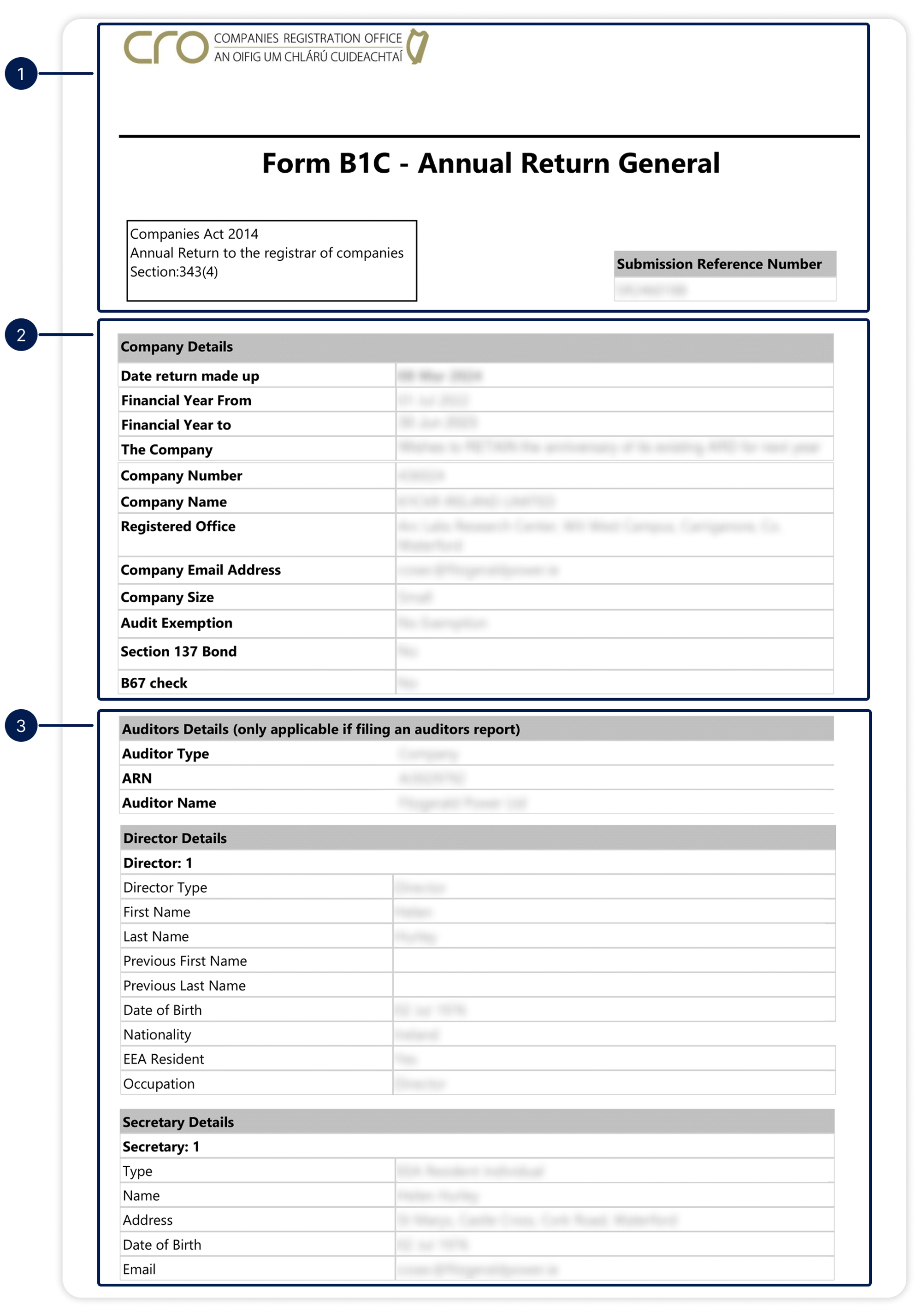

In Ireland, corporate compliance and registry data are managed by the Companies Registration Office (CRO). One of the most essential filings for any Irish entity is the Form B1C, also known as the Annual Return. This document is a snapshot of the company’s legal and financial status as of a specific return date and is filed under Section 343(4) of the Companies Act 2014.

The Annual Return (B1C) includes comprehensive details about the company’s structure, directors, secretary, shareholding, and, when required, its audited financial statements. It’s the backbone of corporate due diligence in Ireland and a key resource for onboarding, compliance, and KYC processes.

What does it look like?

Here's a real example of this document, collected from the CRO register.

Key elements

1. Document Header

It shows it's coming from the CRO register with a unique submission reference number to verify the document authenticity.

2. General Company Details

At the top of the B1C extract, you’ll find basic but vital company metadata:

- Return Date and Financial Year boundaries

- Company Name, Number, and Size

- Registered Office Address and Contact Email

- Whether the company claims an Audit Exemption or falls under Section 137 Bond obligations

This section confirms the entity’s operational footprint and legal existence within the CRO framework.

3. Directors, Officers and auditors

Form B1C discloses all active directors, including:

- Full name, nationality, and date of birth

- EEA residency status and current occupation

- Details of the company secretary, often required under Irish law

- If the company is not exempt from audit, the B1C will specify:

- The auditor’s legal name

- A valid Auditor Reference Number (ARN)

The transparency of executive positions is critical for evaluating governance and potential control risks.

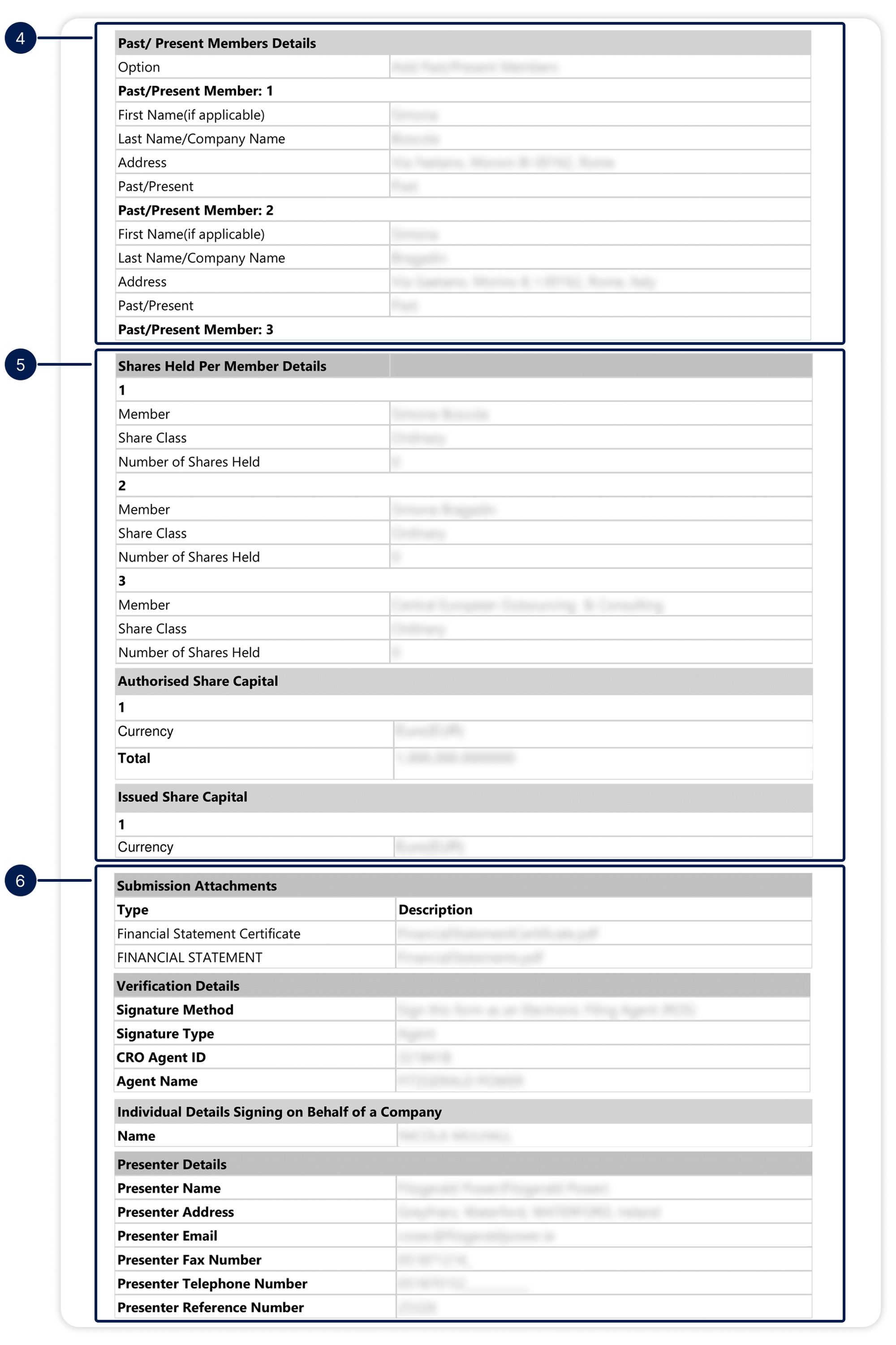

4. Present and post members

You find here all directors and secretaries who played a role in the company.

5. Shareholders

Form B1C reveals:

- A list of current or past members

- The number of shares held per shareholder, the class of shares, and the issued and authorized capital

This information is central for establishing legal ownership and identifying persons with significant control (PSC/UBOs).

6. Financial Attachments

The B1C may include attached PDF documents:

- Financial Statement Certificate

- Annual Financial Statement (full accounts for the reported year)

These documents are often signed digitally and submitted through recognized agents, ensuring regulatory compliance.

With Semaphore

Semaphore provides real-time access to B1C data and documents via its direct integration with the CRO. Through Semaphore, you can retrieve:

- Legal profile: Name, registration, address, and company type

- Directors and secretary: With nationality, EEA status, DOB

- Shareholders: Current members and shareholding details

- Financial documents: Downloadable statements and certificates

- Compliance flags: Audit status, bonds, and exemptions

All data is normalized for instant use in your onboarding or remediation process. Whether you need to verify a beneficial owner or monitor entity changes, Semaphore ensures compliance teams always work with structured, regulator-sourced data.